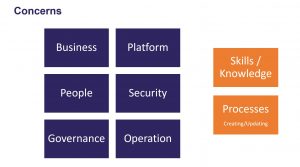

Despite all the benefits of cloud, we often hear concerns about cloud. These generally fall into the following 6 categories which can be addressed with skills/knowledge or processes, be that creating or updating.

One concern within Business is the capex to opex shift. Whilst on premise kit is treated as capex because they are owned assets, consuming cloud services is opex which is treated differently.

I have created a little video of less than 9 minutes – an Accounting 101 demonstrating the capex to opex shift and giving some tips on how to understand it, accept it and move on – there is no magic wand!

A key takeaway is that only assets that you own can be treated as a capex and therefore depreciated. Prepaying for future services can go to the balance sheet as a prepayment and hit the P&L in the month you benefit from the service, but it will hit the P&L as the type of cost it is, eg IT costs, not depreciation. Why is this important? Because IT costs impact the ‘operating profit’ line whereas depreciation is taken into account after ‘operating profit’. Why is ‘operating profit’ important? It is deemed to be a key metric of an organisations’ financial health; the ongoing profitability from day-to-day operational trading. In many industries remuneration schemes use this figure.

Whilst there isn’t a magic wand to make cloud capex, it is important to understand that moving to cloud is much more than a cost conversation. If you haven’t read it already, check out my previous blog on Digital Economics, which highlights that cost is just one aspect of moving to cloud, the real value is in growing the revenue as a result!